In my article last month on creating a budget I briefly mentioned how I didn’t put credit cards on the budget and why. It is not that I am against them, far from it. I have 5 cards open at the moment, all with zero balance. 3 of the cards I keep for emergencies and don’t carry with me, the other 2 are rewards cards. I use one for personal use and the other for business use and travel to maximize my points and rewards.

Each month I pay off any balance on the cards to keep from having to pay any interest on the loan. Wait, what? You said credit card right? I did and a credit card is a loan. You’re using money you don’t have to pay for something now and paying the ‘loan’ back in installments each month. Just like a regular loan, there are interest charges on the outstanding balance. It is the price you pay to borrow that money upfront. The ‘interest’ fee is called a finance charge. The larger your outstanding balance the more interest that gets tacked onto that balance each month.

Only paying the minimum due

Those finance charges are exactly why I pay off any charges each month. Early in my credit use journey, I maxed out all my cards and only was paying the minimum payments each month. The finance charges started adding up and over the course of 20 years, I shelled out at least $20,000 in interest charges. That’s at least $20,000 that I will never get back and can’t use for things I want to do or buy or invest towards retirement.

How to tackle credit debt

So how do you get your credit debt under control? Two things:

- Have a budget

- Pay off the highest interest card first

If you didn’t read my post last month on creating a budget, I urge you to do that before continuing. Once you know how much leftover money you have available each month, you can plan to pay off your credit debt starting with the highest interest card. It may sound counter intuitive, but to make it work, you put as much extra money each month on the highest interest card to pay that off as quickly as possible. If you have more cards, only pay the minimum payment on those. Once that first card is paid off, you do the same with the next highest interest card and so on. This will reduce the total amount of interest you end up paying to the banks and keep that money in your accounts to put to work for things you need or want.

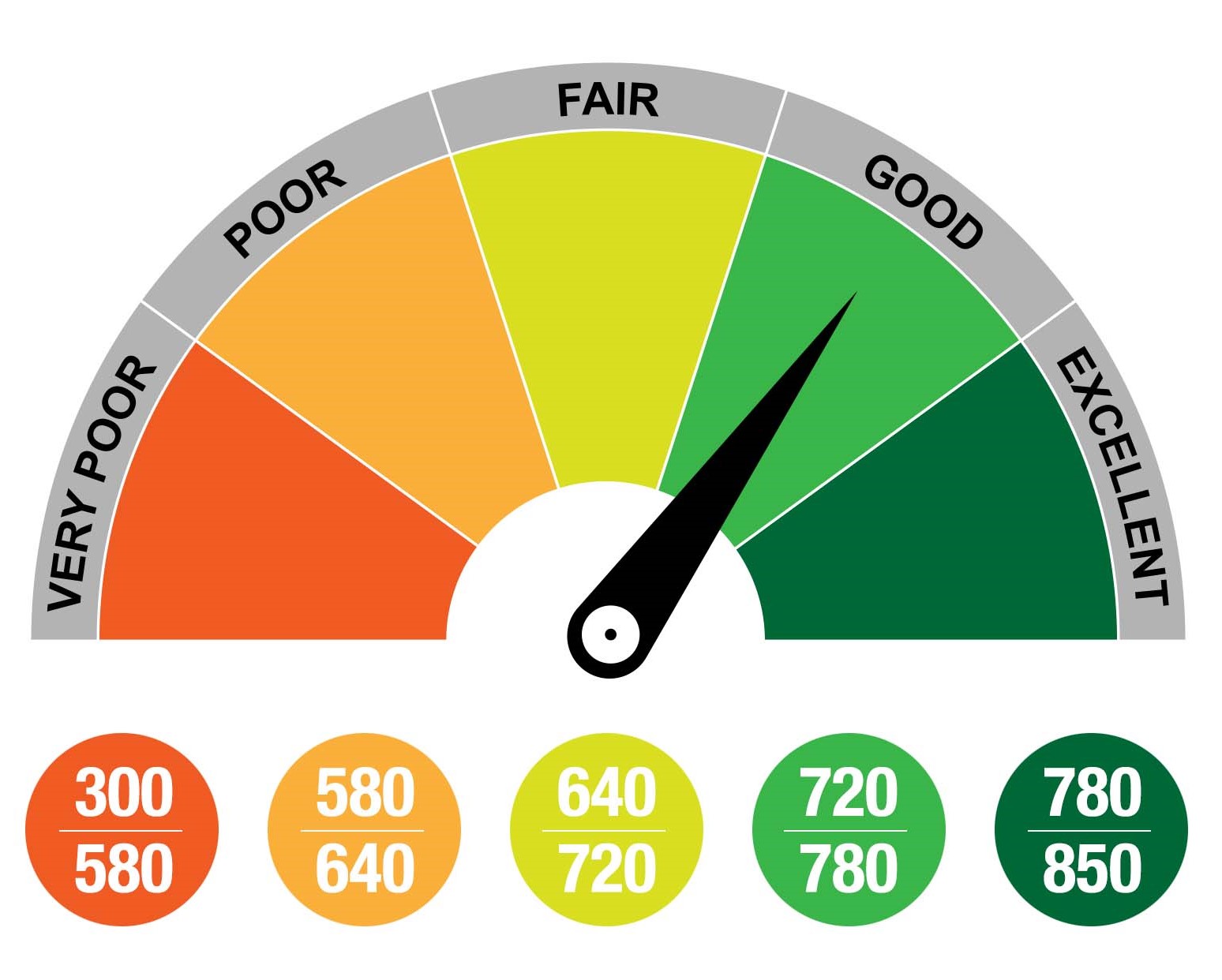

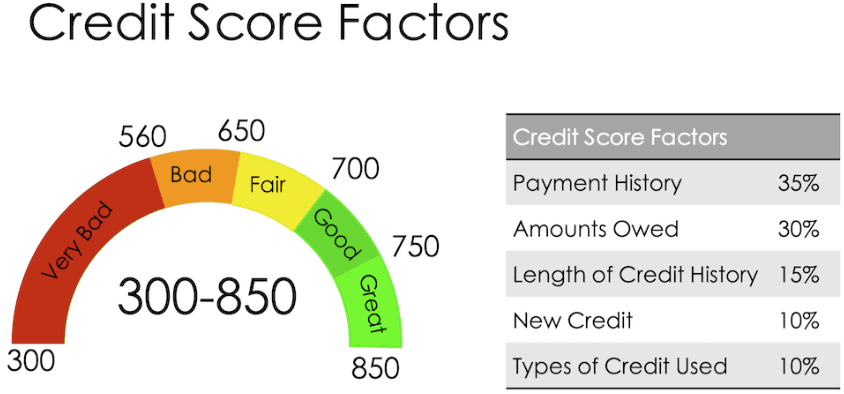

Credit Scores

If you aren’t familiar with the commercials for apps Credit Karma or Credit Sesame, I’m not sure where you have been hiding. While I don’t use either of these, I do agree it is important to know your credit score. Most credit cards these days provide you with a FICO score. It can vary from card to card depending on which reporting bureau they use to determine your credit history.

Your credit score is calculated on a number of factors.

For more detail on how credit scores are calculated click here.

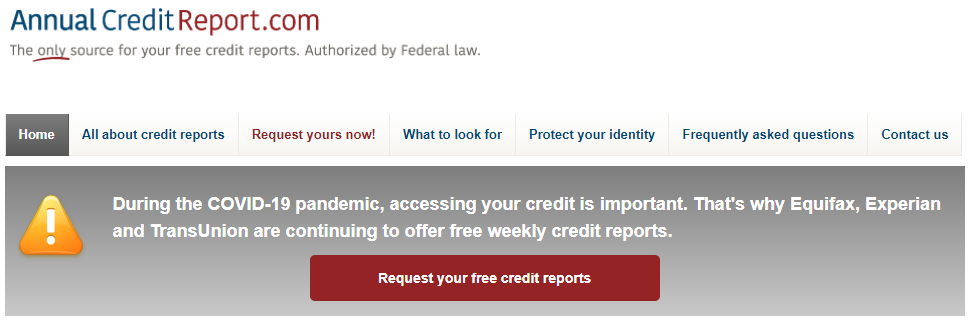

Annual Credit Reports – FREE

While most cards these days provide you with your FICO score, that doesn’t show you all the details of what is in your credit report and if there is information in one but not the others that can have either a positive or negative affect on your FICO number which is why you need to review your reports at least once a year. By law you are allowed one free credit report each year from each of the 3 credit reporting bureaus.

- Equifax

- Experian

- TransUnion

To get your free reports go to AnnualCreditReport.com.

Right now during the COVID-19 pandemic they are offering free reports on a weekly basis. I recommend taking advantage of this before they stop it.

During normal times, you can get your report more often if you purchase a credit monitoring service, but I would only recommend that if you have had your identity stolen an need to clean up the damage caused. In many cases the monitoring provided by a company that lost your data is not sufficient. In some cases you can have the cost deferred or reimbursed by the company if you can show that without the service you would be negatively impacted. By that point any company already doing damage control for losing your data will do just about anything to mitigate further negative publicity over the breach and demonstrate their efforts to help you recover from the situation but you will probably have to have a lawyer fight for you to get it.

Dispute or update incorrect data

Once you have your reports from each of the 3 credit bureaus you need to take the time to carefully look over all the information.

- Is your address information correct?

- Do they have the right job information listed?

- Do they still show cards or lines of credit open that have been closed?

- Are there any negative reports about your payment history that is not correct?

This barely scratches the surface of what to look for. For a much more comprehensive and detailed checklist of what to look for in your reports click here.

You can and should dispute any information that is not accurate and I would be surprised if you didn’t find at least one thing wrong. I check my reports annually and constantly dispute items that negatively affect my credit score.

The bureaus are notoriously bad at keeping up with your addresses and job history. My most recent review showed addresses and jobs that I haven’t lived/worked at for 20 years on one report. How or why it changed and went back in time is beyond me.

Cancelling unused cards

If you have open lines of credit that you forgot about, now is the time to determine if you really need to keep it open. If not, cancel it. The number to call should be listed on the report.

While writing this article I’ve decided to close 2 of the 3 cards I don’t carry. One hasn’t been used in 7 years, and the other somewhere between 15-20 years and to be honest, I no longer need them. 3 open lines of credit are more than enough for my needs.

Keeping old lines of credit open

Sometimes it makes sense to keep an older line of credit open. Is that a risk? Yes and no. It’s a risk if someone gets ahold of my information and uses it to fraudulently run up charges, but it also helps my credit score. How you ask?

By having a card that is 20 years old with zero balance I’m showing I can responsibly use credit and that I’m a lower risk since I have had that credit line for 20 years. All my payment history is available and the account wasn’t closed for going into default for non-payment. Currently my oldest credit line is 34 years. I’ve had various cards on the account over that time, but I’ve kept it open continuously my entire adult life.

Chasing offers and jumping to new cards continuously can hurt your credit score. Since you have a short history on these cards it’s hard to determine a long term pattern of behavior which can show stability. The algorithm looks at that behavior as a high risk thus lowering your score. A consistent payment history over time shows that stability thus lowering the risk you pose to defaulting on what you owe.

Additional Reading

Almost every financial institution has information available on their websites these days. You can google using credit wisely or check out the following pages below:

- 6 Habits to Help You Use Your Credit Wisely | Capital One

- How To Use Credit Wisely – Consumer Credit

- 5 tips to use your credit card wisely and steer clear of debt (usbank.com)

- Using Credit Wisely | MakingCents | Navy Federal Credit Union

- FUNDamentals (americafirst.com)

Last Updated on July 19, 2021