It’s that time a year again where everyone is scrambling to file their taxes. For the second time in two years, the US Government has extended the deadline for filing and paying your taxes. This year until May 17th instead of the normal April 15th deadline. With all the focus on finances this time of year I thought it would be a good time to discuss something everyone should have but most do not: a budget.

- Do you know how much you spend each month? I mean really?

- Do you track every trip through the Starbucks or McDonald’s drive-thru?

- Do you only use debit and credit cards or are you still paying for things with cash?

- If you use credit cards, are they paid off each month?

- Are you paying more than the minimum payment each month?

- Do you have an emergency fund of at least $500?

- Can you afford to go on a weeklong vacation away from your home without going further into debt?

If you answered ‘no’ to any of those questions you’re not alone. Let me share my story with you.

My financial reckoning

During the first 5 years of my adult life, I didn’t have a budget. I was young and naïve. I lived in the barracks on an Air Force base so I didn’t have to pay rent or basic utilities like electric and water. My paychecks weren’t large but I was able to do most of what I wanted to do in my free time. It was the early 90s and Quicken had just come out. I had just gotten my first PC and I decided it would be nice to see where all my money was going since I was living paycheck to paycheck.

Using my bank and credit card statements I went back 5 years to when I first opened my bank account entered all the data I had into my computer. Back then I used cash for most purchases. Each month there were numerous ATM withdrawals of $20, $40 and $60 (at the time the ATM only disbursed in $20 increments). Shortly after starting this exercise I got stationed in Germany for 3 years. I received a monthly cost of living adjustment that added $500 a month to my military paycheck which allowed me to enjoy my time in Europe and be debt free when I returned to the US. I never finished reconciling my expenses and thought I was good to go, but oh was I wrong.

In familiar territory

Since I hadn’t updated my budget nor kept up with tracking my spending thinking I was good to go, I suddenly I found myself back in a familiar position. Credit cards maxed out, making minimum payments. How did this happen again?

I found that in one year alone, I spent over $1,200. JUST. ON. MCDONALDS.

Fast forward 18 months and I had left the military and was in a much better paying corporate job. By this point I was using credit and debit cards for most purchases. I was looking to buy a house and needed financing so picked up where I left off 5 years earlier to get a handle on my spending. Being able to download my data into Quicken at this time made it much easier to catch up and generate reports on my finances. I could finally see where my money was going. It was not pretty.

Over the course of 10 years, I had withdrawn a total of $50,000 in cash from the ATM and I had absolutely no idea what I spent it on. Most of it probably went to beer, pizza and fast food, bars and clubs. Some of it went to my hobbies, gas for my car, etc. But I didn’t know exactly how I had spent it and nothing of note to show for it. The next thing I discovered really blew my mind.

I should have bought stock in McDonalds

Since I was using debit and credit cards for almost all purchases at this point, I found that in one year alone, I spent over $1,200. JUST. ON. MCDONALDS. Working in downtown Chicago, commuting via train from the suburbs each day, I was eating most meals at fast food joints. I know most of that $1,200 went to the McDonalds in Union Station as I passed it twice a day on my way to and from work.

But I wasn’t just eating McDonalds. I was eating at all the other fast food restaurants as well. You need variety right? Let’s just say that it was enough to break me out of bad habits and get me on the right track to not only living within my means, but also saving for retirement which as of this writing I should be able to do in 5-7 years if things continue the way they are. But I would not be in the position I am in if I had not gotten a handle on my spending.

Having a budget will help you get your finances under control so you can answer ‘yes’ to all of the questions I asked at the beginng. Here’s how.

Income

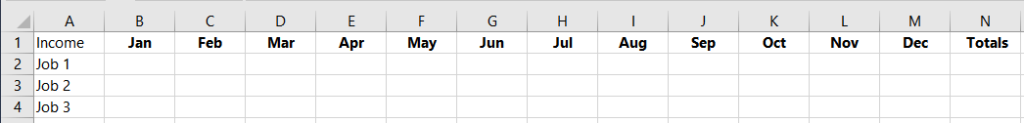

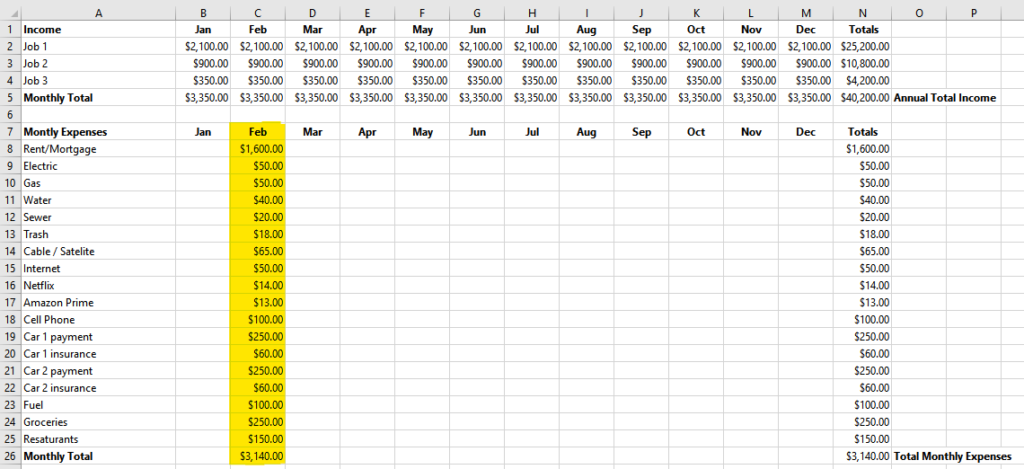

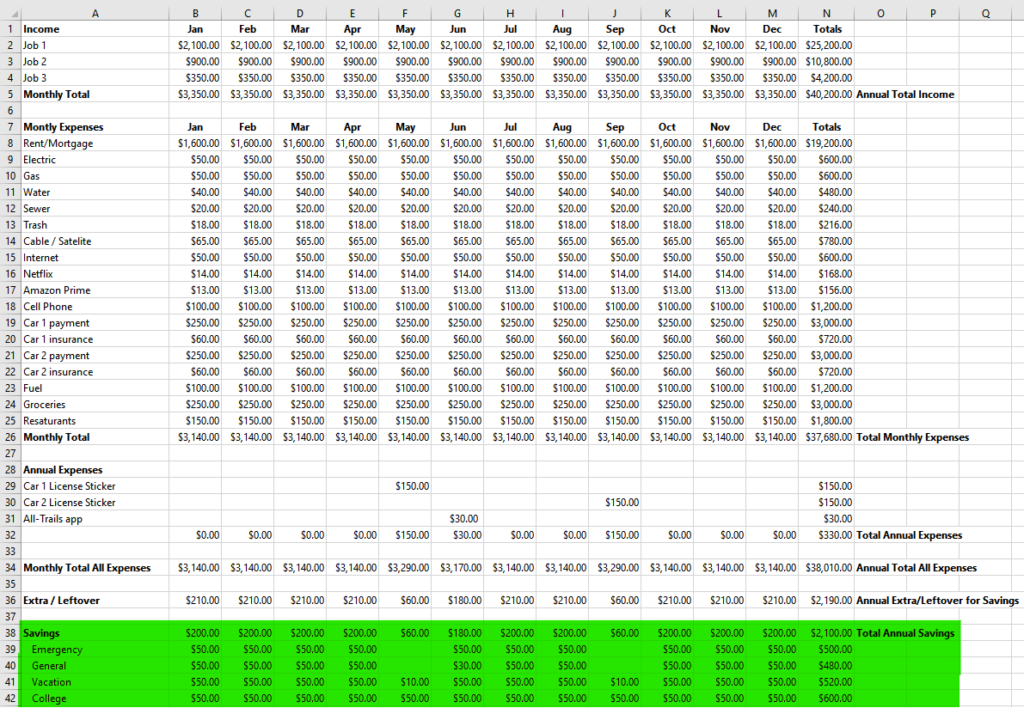

Start by opening up a spreadsheet (Microsoft Excel, Google Sheets, Apple Numbers, LibreOffice Calc, etc). Across the top start with Income and list the months of the year and a Totals column.

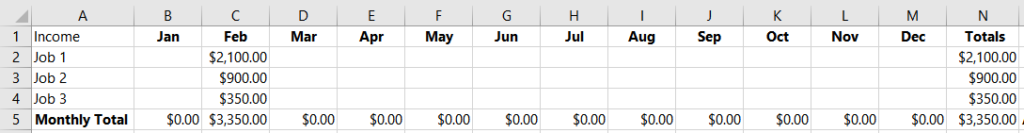

In the second row of the first column start listing your jobs and your monthly take-home pay. Take-home is your pay after taxes are taken out and what is direct deposited to your bank account or the value of your paycheck. If it varies, start with whatever you brought home last month. It’s ok to skip to whatever the previous month was when you start this. Since it’s March I’m starting with February.

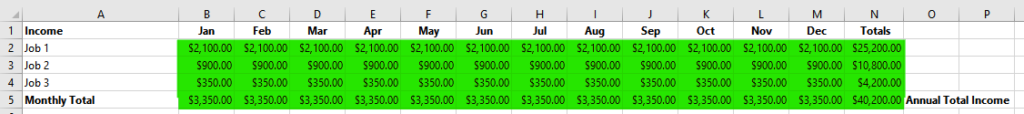

For my example, I am using a couple with one person have a full time office job and the partner having 2 part-time jobs. Combined they take home $3,350 a month. How do I know that? That’s the beauty of spreadsheets, it does the calculations for you so you can see the big picture. Using the Sum formula I calculate each monthly total, but also each job total across 12 months. Since I only have one month entered right now, the numbers all match. When I copy the totals across each month, I get a fuller picture like this:

I can now see that the couple has a take-home income of $40,200 a year. Their gross-income will be higher but since taxes and other items are taken out, the budget needs to focus only on what they have that they can spend.

This is a mistake a lot of people make. They know their gross-income number…say $55,000/year, but they forget to take taxes, medical & dental premiums, 401k contributions, etc. into consideration as that all gets taken out of your paycheck before you get it. So in reality, they don’t have 55,000/year to spend.

Expenses

Monthly Expenses

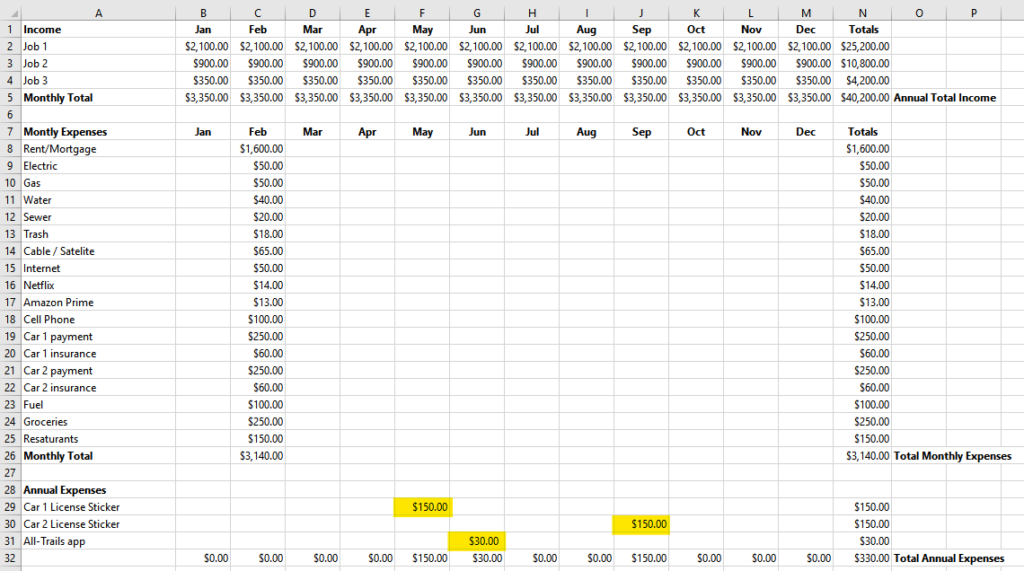

Now that we know our income, it’s time to list our expenses. Start with your monthly expenses like rent/mortgage, car payment, insurance, utilities, food, etc.

Annual Expenses

Now let’s add annual expenses. Include items like your license plate sticker renewal for your cars and any annual subscription fees for apps or services.

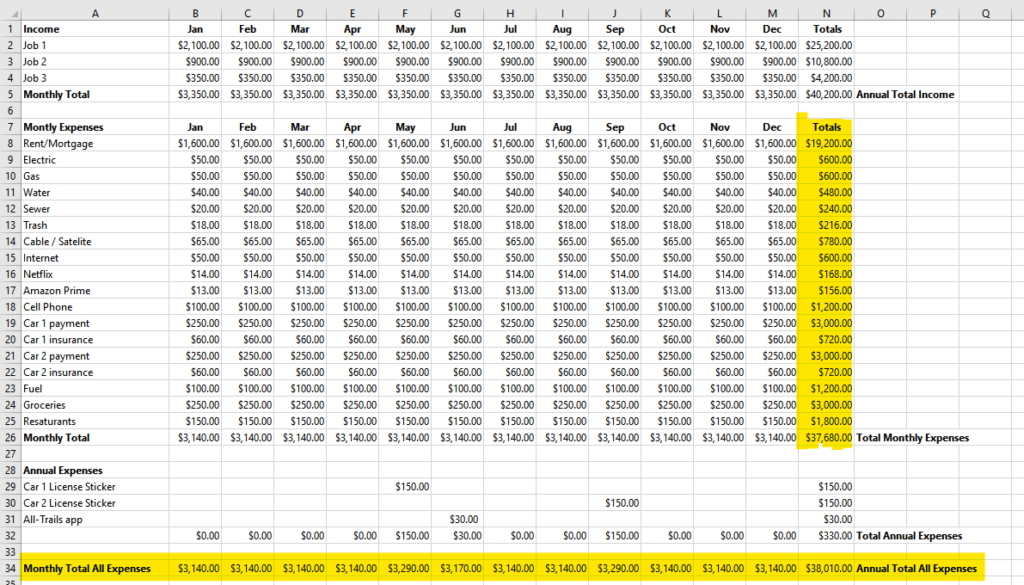

Do the same thing you did in income and copy the monthly expenses to each month. Don’t worry if there are fluctuations from month to month right now. Your electric and gas bills which tend to be higher in winter and summer and lower in spring and fall. From a budgeting perspective it all averages out. Leave the annual expenses as they are since they only occur in that one month each year.

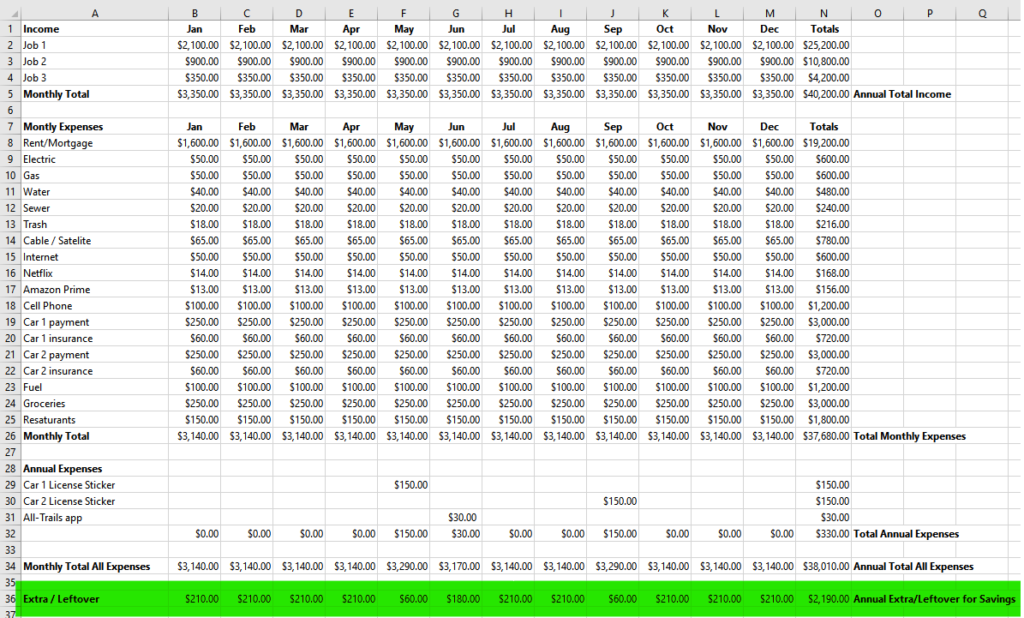

Leftovers

We can now figure out how much extra or leftover there should be each month so we can start contributing to savings to cover things we are planning for. Pay attention to the changes in months that you incur an annual expense that will reduce the extra available that month.

Savings

And finally let’s look at savings. A lot of advisors will tell you to pay yourself first to make sure you are putting money in savings, but in reality I have found that does not work for many people. People that do that just end up taking that money back out of savings to cover bills each month so they never build up their savings. What works for me and others I have spoken with is seeing the big picture of how much I’m spending each month and year on certain things. Then realizing there are areas I can cut back so that I can have extra money to put in savings for things I want to do.

Budget for big purchases

Just like budgeting for monthly and annual expenses, you also budget for specific items you need to save for like college if you have young children, or a vacation you want to take in summer and your emergency fund to make sure you have money in savings for those eventualities. And don’t tell yourself, “oh, I’ll just catchup next month”….cause you won’t….where will the extra come from?

And there you have it. Your annual budget. Now you can take a look at the big picture and see where you need to make adjustments if you want to have more savings or spend more money in a particular area.

Room for improvement?

In this example, I’m spending $780 a year on cable/satellite service but I also pay for two streaming services. Maybe I can cancel cable/satellite to spend that $780 on other things, like a faster Internet connection to enjoy my streaming more. Maybe I eat out a couple extra times each month or I can just boost my savings. Having a budget give you the flexibility to know where you money is going so you can decide if it is money well spent or not.

What about credit cards?

Oh you noticed I didn’t have any credit cards listed on this budget. Good catch. If you have credit card debt, list each one as an expense and try to pay more than the minimum payment each month. Suffice to say any charges I make on a credit card are already accounted for in my budget items listed. Think fuel for my car, groceries, eating at restaurant, etc. Those are already budgeted so if I pay for them using a credit card I have the money allocated already to pay that bill each month.

So yes, I do use credit cards, but I never spend more than I can afford to pay off each month. It is a rare occurrence if I ever carry a balance these days because I hate incurring finance charges. This is something I learned the hard way as a young adult. I had never been taught how to use credit wisely and over the course of about 20 years gave away in excess of $20,000 in finance charges. That’s $20,000 that I will never get back or be able to use for things I want to do and helped make these greedy banks even richer. I will explore using credit in more depth in another post.

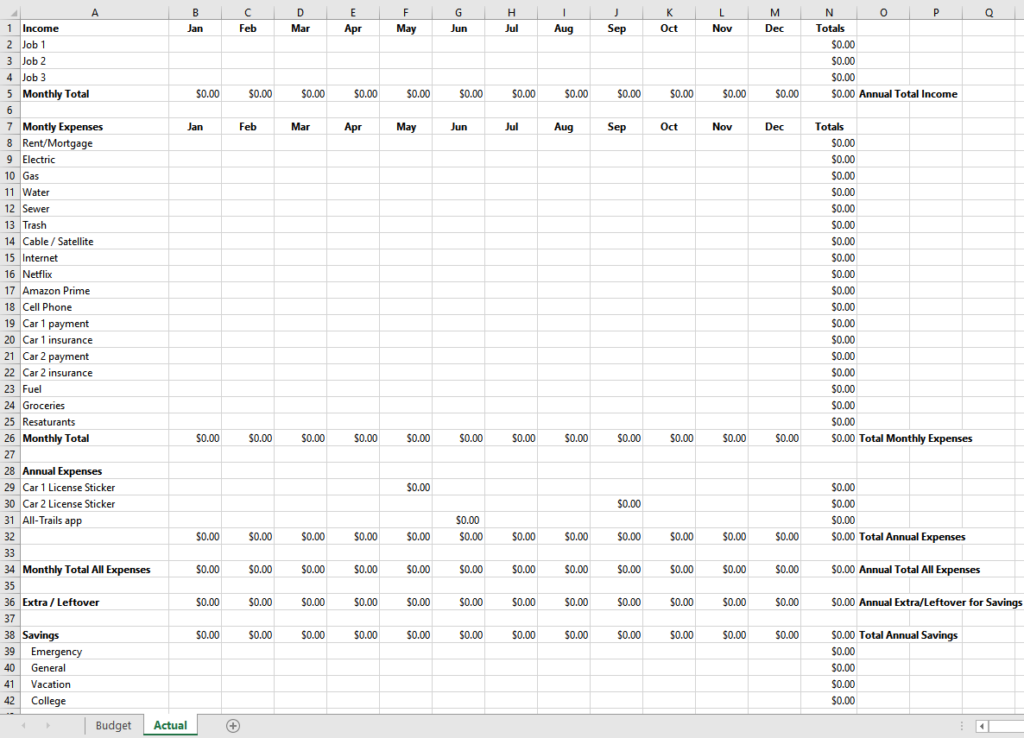

Monthly review and tracking of actual spending

Take it to the next level by making a copy of your budget and creating a tracker so that you can compare your budget with your actual income and expenses each year to see how you’re doing. You would be surprised how it helps to keep you on track.

Once you have made your copy, clear all the amounts in the income and expense cells (leave the column and row total formulas). Then each month type in the actual values of your income, expenses and savings in each category. Forget something on your original budget or need to add something new? That’s ok, just add a new row on your actual sheet to track the expense. You can go back to your budget and add it as well going forward to see how it affects your totals for the year.

One bonus to tracking your actual income, expenses and savings each year is that you will have a much more accurate budget already created for the following year that only needs to be tweaked or modified if you want to change your spending habits that next year.

There’s an app for that

There are lots of apps available these days to help you create a budget and track your spending if you don’t want to use a spreadsheet. Check out some popular ones below.

- Mint.com (intuit.com) | Budget Tracker & Planner | Free Online Money Management (FREE)

- Wally 3.0 | Get Spending Insights, Set Goals, Increase Savings (FREE)

- Goodbudget | Best Home Budget App for Android, iPhone, & Web (FREE & Premium)

- PocketGuard | Money Management, Spending Categorization, Fraud Protection, Personal Finance

- Envelope Budgeting (mvelopes.com) | Best Budget Tracking App | Improve Financial Future (Subscription)

- YNAB (youneedabudget.com) | Personal Budgeting Software for Windows, Mac, iOS and Android (Subscription)

Additional Reading

If you want to learn more check out these resources

Comments?

Hope this helps you get your finances on track and achieve your goals. Leave any questions or comments below.

Last Updated on August 24, 2021